For perspective, Coinbase’s net margins stood at an incredible 65% over the first half of 2021. So is the Coinbase stock a buy at current levels of around $256 per share? Coinbase currently trades at just about 21x projected 2021 earnings, which is a reasonable valuation for a futuristic stock with solid earnings potential.

Also, check out our analysis on Coinbase Revenues: How Does COIN Make Money? for details on the company’s key revenue streams and how they have been trending. See our analysis on Coinbase Valuation : Expensive or Cheap? for more details on Coinbase’s valuation. We value Coinbase at about $300 per share, marking a premium of about 13% over the current market price.

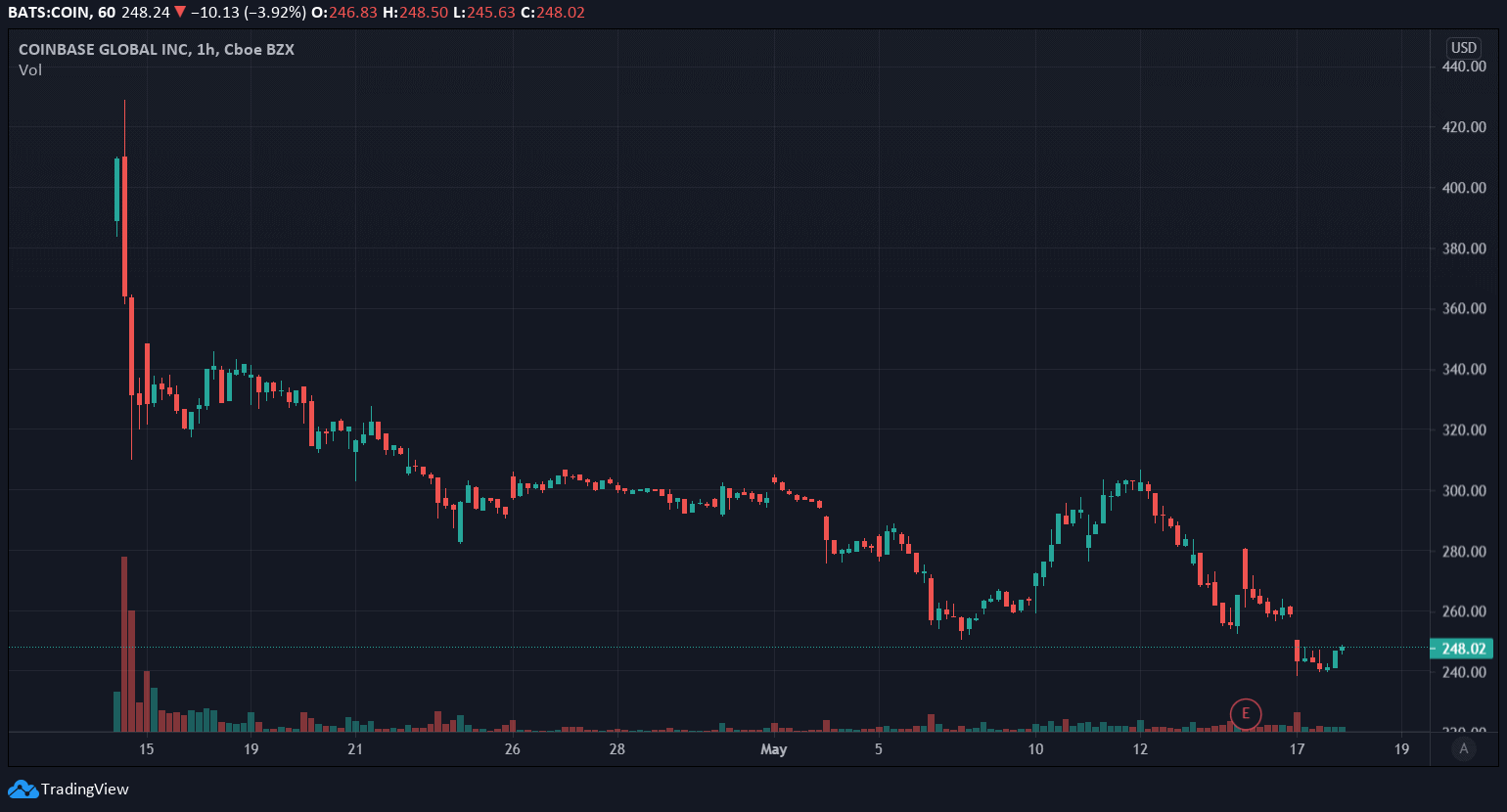

That said, the stock could still be worth a look for long-term investors. This could hurt momentum for Coinbase in the near term. However, the cryptocurrency market is inherently cyclical, and the odds are that we could be approaching a market peak given the Fed’s stance on interest rates. For perspective, Coinbase’s net margins stood at an incredible 57% over the first three quarters of 2021. So is Coinbase stock a buy following the sizeable correction? The stock currently trades at just about 22x our projected 2021 earnings, which is not a particularly rich valuation for a highly profitable and futuristic stock with solid long-term earnings potential. The Fed’s stance appears to have also impacted cryptocurrency prices, with bellwether crypto bitcoin down by about 20% over the past month. Separately, investors have likely been reducing exposure to high-growth stocks, such as Coinbase, due to rising inflation and an increasingly hawkish stance by the Federal Reserve, which has indicated that it could consider speeding up the tapering of its large-scale bond-buying at its next meeting. Firstly, Coinbase’s Q3 results - which were reported in early November - missed expectations due to some weakness in the number of transacting users and trading volumes. There are a couple of factors driving the weakness in the stock. Also, check out our analysis on Coinbase Revenues: How Does COIN Make Money? for details on the company’s key revenue streams and how they have been trending.Ĭoinbase stock (NASDAQ: COIN) has declined by almost 26% over the last month trading at levels of around $264 per share, considerably underperforming the S&P 500 which declined about 3% over the same period. Coinbase has built a solid reputation for transparency, security, and compliance, and this could make it the go-to platform as bitcoin and other cryptos continue to gain traction. However, we still remain bullish on Coinbase, with our price estimate standing at about 35% over the current market price.

Considering this, we have revised our price estimate for COIN stock from around $300 per share to about $240 per share.

This could mean that Coinbase’s revenue growth could be muted, with the stock likely to remain out of favor with investors. With interest rate hikes and tighter monetary policy on the horizon, investors will likely prioritize productive, cash flow-yielding assets, over cryptos. However, the cryptocurrency market is cyclical, and 2022 doesn’t look like a particularly promising year. For perspective, Coinbase’s net margins stood at a solid 57% over the first three quarters of 2021. So is it time to buy Coinbase stock following this big sell-off? The stock currently trades at just about 15x our projected 2021 earnings, which is not exactly a rich valuation for a highly profitable and futuristic stock with solid long-term earnings potential.

0 kommentar(er)

0 kommentar(er)